non filing of income tax return notice under which section

If you have a genuine explanation for not filing and if the officer is satisfied with the reason you may not have to pay the penalty. The income tax department has been capturing information on financial transactions activities relating to you through Non-filers Monitoring System NMS.

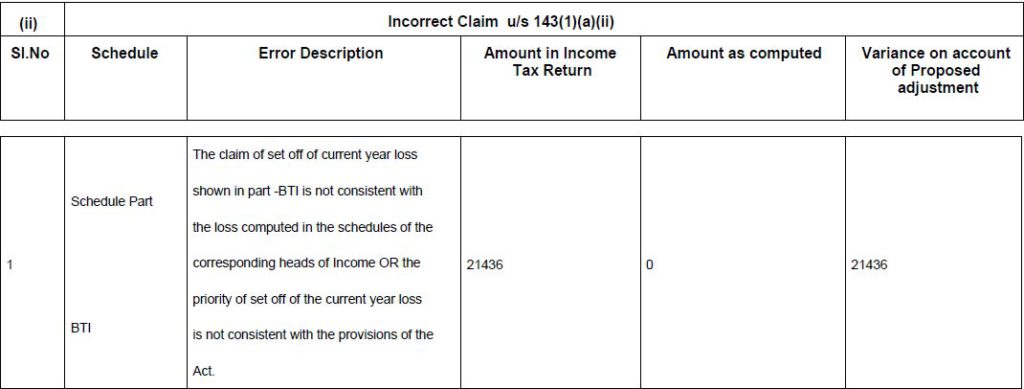

All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center

The income tax department may issue a notice under Section 271F for not filing ITR.

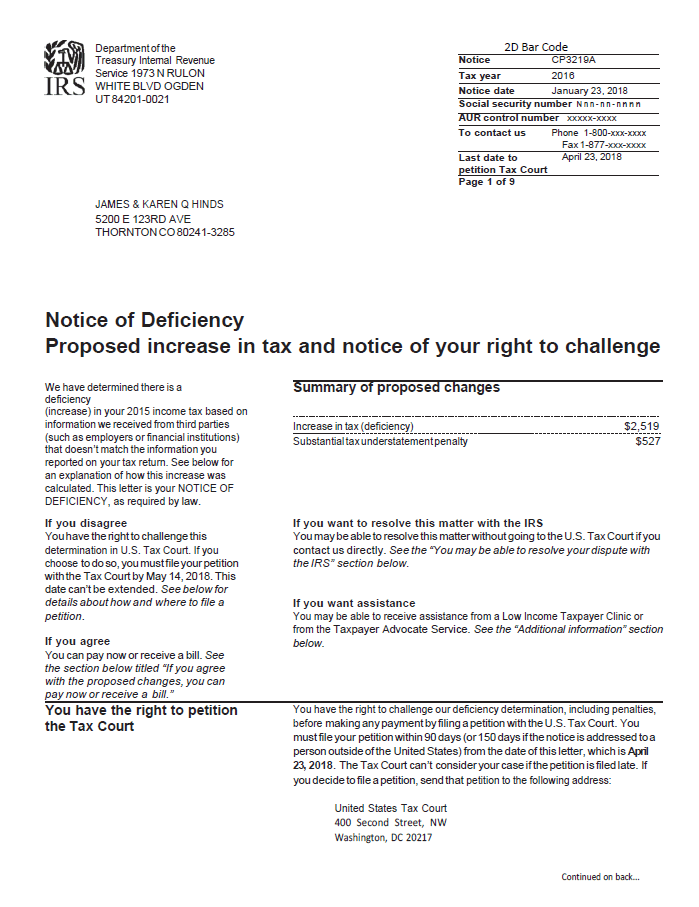

. Using an automated system the Automated Underreporter AUR function compares the information reported by third parties to the information reported on your return to identify potential discrepancies. See IRM 20123 Failure to File a Tax Return -. You get a defective return notice under section 139 9 of the Income Tax Act.

Section 1432 Notice under this section is received after a detailed enquiry has been done by the assessing officer. Non-filing of Income Tax returns is an unlawful act and can attract serious consequences to the tax-payer. This is applicable to those who did not file their income tax return.

A person who fails to file return within due date will have to pay a penalty of higher of Rs1000 or 01 per cent of tax payable for each day of default. The income tax department may issue a notice under Section 271F for non-filing of IT Return. IRC 6651a1 imposes a penalty for failure to file a tax return by the date prescribed including extensions unless it is shown that the failure is due to reasonable cause and not due to willful neglect.

You may still receive a notice for non filing of ITR even if you were not required to file your ITR. In addition to the above the. How to handle notice received for Non-Filing of Income Tax Return Asst Year 2013-14.

If you have been filing. An Income Tax Return is mandatorily required to be filed if the Total Income is more than the minimum amount which is exempted from the levy of tax. Amendment in Section 182 of the Income Tax Ordinance 2001.

You get a defective return notice under section 139 9 of the Income Tax Act. The FBR said that amendment has been made in Section 182 of the income Tax Ordinance 2001. Select the checkbox on the right hand side for Verification of Nonfiling.

You may have to pay a penalty of up to Rs. Notice under section 1421 After filing Income tax return if the assessing officer require additional information then income tax notice under section 1421 is issued in case of non-filing of return a notice under section 1421 is issued mentioning to file the return before the date as mentioned in the notice. Section 1432 Notice under this section is received after a detailed enquiry has been done by the assessing officer.

Section 206AB states higher tax rate for tax deduction at source TDS while making payments or collections. 5000 for missing the deadline. This notice is about some dues which the tax payer owes to the department.

However the minimum penalty shall be Rs10000 in case. Whereas you have not furnished a Return of Income for the tax year mentioned above required to be filed under sub-section 4 of section 114 of the Income Tax Ordinance 2001 XLIX of 2001You are hereby requested to furnish on or before the date mentioned above a Return of Income for the said tax year in the prescribed form and verified in the prescribed. Even if you have genuine reasons for not filing the income tax returns like your income for the financial year being under the basic exemption limits due to loss of job or less profits booked in business it is still recommended to file income tax returns.

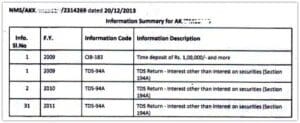

What if belated return is not filed. Notice was acknowledged on 05042004. The IRS receives information from third parties such as employers and financial institutions.

Once received you need to respond to it within 15 days from the date of receiving the notice. If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department. 652 Notice of Underreported Income CP2000.

Section 139 1 of the Income Tax Act 1961 prescribes the categories of the person who are required to file their return on or before the due date of filing return. If you have a genuine explanation for not filing and if the officer is satisfied with. This article focuses on such cases wherein you may receive a notice for non-filing of ITR.

If the taxpayer fails to comply with all the terms of a notice issued under section 1421 or fails to comply with the direction issued under section 1422A If the taxpayer fails to comply with all the terms of a notice issued under section 1432 Thus Non-Filing of the Income Tax Return may result in the Best Judgement Assessment. 5000 for missing the deadline. If the assessing officer feels some income has been missed a notice is sent under this section as the income will need to be reassessed.

You may have to pay a penalty of up to Rs. Filing Tax Return under Section 1394A is needed by every individual who receives an income derived from the property held under any trust or other legal obligation either wholly for religious or charitable purposes or partly for such purposes only or of income being voluntary contributions referred to in sub-section 224iia shall in. A statutory notice under Section 148 of Income Tax Act 1961 dated 30032004 was issued to the petitioner to prepare a true and correct return of total income including the undisclosed income assessable for the assessment year 2002-2003 within 30 days from the date of service of the notice.

You can find another option view my submission. Income tax department has started sending notices to non-filers for the assessment year 2014-15. Any person other than a company or firm if his total income during the previous year exceeds the maximum amount chargeable to the Income Tax.

All groups and messages.

It Notice For Proposed Adjustment U S 143 1 A Learn By Quickolearn By Quicko

How To Respond To Non Filing Of Income Tax Return Notice

All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

What Is A Cp05 Letter From The Irs And What Should I Do

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Income Tax Notices How To Check Income Tax Notice Online Tax2win

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

Irs Notice Cp80 The Irs Hasn T Received Your Tax Return H R Block

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Irs Letter 707c Refund Or Return Delayed In Processing Refund Forthcoming H R Block

Notice Of Deficiency Overview Irs Forms Options